Top 6 Reasons to Have a Jewelry Appraisal for Insurance Purposes:

You probably would prefer not to think about your jewelry treasures being damaged, destroyed and/or lost during a catastrophe; but it’s prudent to be prepared. Whether you spent years building your fine jewelry collection or you’ve recently acquired your first exquisite piece, you should insure each item to value, just in case the unexpected happens. To do that properly, you must have your jewelry appraised for insurance purposes.

- Appraisals are important to the insurance process. If you have a sentimental attachment to your most cherished jewelry pieces, you’ll love them no matter what they’re worth. Still determining a value is important, especially when you’re purchasing insurance. You need to know if your Homeowners Policy jewelry limit will cover them, or if you need a valuable items endorsement or a separate policy. If you need a special endorsement or policy, underwriters will base your coverage amount on the appraised value of your jewelry and your insurance premium will be based on that same value.

- Insurance companies never take your word for value. Even if you have had the same insurance agent for years, that relationship will only take you so far. Your agent might trust you when you tell him the value of your newest jewelry piece, but the insurance company underwriters will want more. Before an underwriter finalizes the jewelry schedule on your Valuable Items Policy or your Homeowners Policy jewelry floater, he will insist on a written appraisal from a reputable source.

- A sales receipt is not the same thing as an appraisal. Insurance companies won’t accept a receipt of purchase as a legitimate measure of value. It doesn’t matter how much you paid for your jewelry. When writing a policy or paying a claim, the insurance company relies on the actual appraised value, not the cost.

- The insurance company might require updated appraisals. Even if your insurance company doesn’t require regular appraisal updates, you might want to get them anyway. It’s the best way to make certain you are insuring your jewelry to its proper value. If the market prices of precious metals, diamonds, and fine jewels rise or fall, it could change the value of your jewelry. Vintage, antique, and collectible jewelry styles go in and out of favor, causing the values to go up or down. Values rarely remain constant, and your policies should change accordingly. Ask your agent or underwriter about insurance policy appraisal guidelines.

- You may still have to prove the value if a loss occurs. When you file a claim, the insurance company won’t simply write a check for the amount of your stated coverage. They will verify the details before settling your claim. If a thief stole your jewelry, they will want to see a police report. If you lost it or it simply disappears, they will want to know how and why. If you have no witnesses, the insurance company adjuster may decide to talk to friends and relatives about you and your jewelry.

- Has it been more than 3 years since your last appraisal? Many insurance companies recommend a yearly update of values and some require it. Most insurance policies do not include automatic increases to account for inflation and increases in the cost of the materials and labor, and those that do don’t accurately track and apply those fluctuations in the market. Thus, your premium may continue to go up even if the market is going down. It is best to update your appraisal on a regular basis.

Regular appraisals can help you prove an insurance claim. An appraiser can attest to the quality, design, condition, and valuation of your jewelry. If a jewelry professional has inspected your collection a number of times over the years, the dated documentation can verify ownership and custody.

Diamond Education

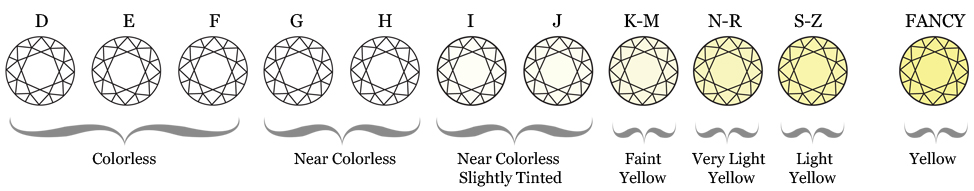

Color

Color Gem-quality diamonds occur in many hues. In the range from colorless to light yellow or light brown. Colorless diamonds are the rarest.

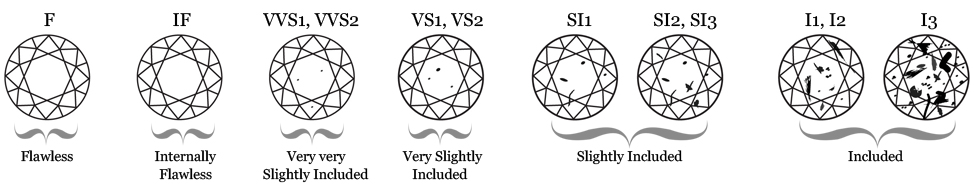

Clarity

Diamonds can have internal characteristics known as inclusions or external characteristics known as blemishes. Diamonds without inclusions or blemishes are rare. However, most characteristics can only be seen with magnification.

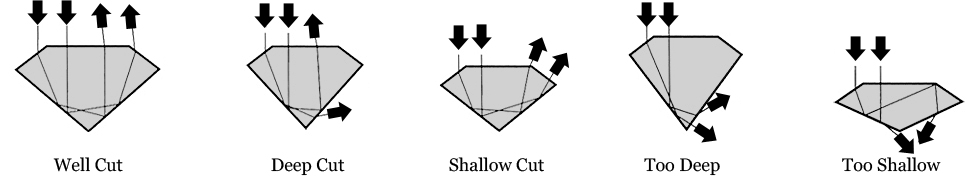

Cut

Of all the 4Cs, cut has the greatest effect on a diamonds beauty. In determining the quality of the cut, the grader evaluates the cutter’s skill in the fashioning of the diamond.

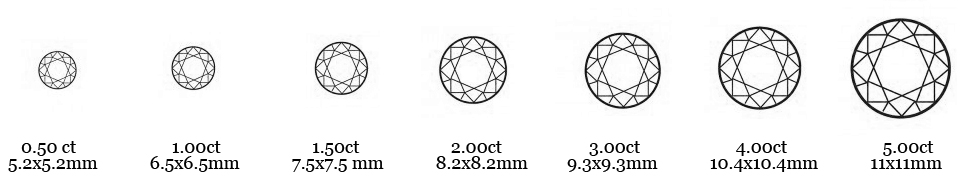

Carat

This is the weight of a diamond measured in carats. As the carat weight of the diamond increases so does its rarity and therefore its price.

One carat is divided into 100 “points”. The carat-weight of a diamond is the easiest measrement to determine. Most importantly, two diamonds can be of equal carat-weight, but their value can differ greatly due to their cut, color and clarity.